Cancer Insurance

If you think that you are covered having health insurance but no Cancer insurance, you’d be wrong. And here’s why…

Cancer diagnoses is a physical strain and an emotion drain. Thankfully many will survive with modern medicine. How you will survive financially is quite another. Today, with as many as one in every three people getting diagnosed with some form of cancer, you’re more at risk than ever. With financial expenses and loss of income, the difference between having Cancer insurance or not, will make all the difference.

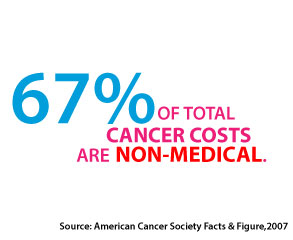

Healthcare plans cover only medical expenses, while cancer insurance covers medical and non-medical bills. The items not medical related can range from travel and lodging to a treatment center, to loss of work and your income. These are the costs many do not think about till it’s too late. They are also the ones that claim bankruptcy or lose their entire life savings.

What is Cancer Insurance? Simple understanding of the plan

Cancer Insurance is typically a separate supplemental policy, (or added on a health insurance policy as a rider, but not recommended) that pays out a designated amount upon diagnosis. Pay generally goes to the policy holder directly, rather than the medical providers. Coverage comes either as defined benefit amount for each covered treatment as defined by the policy, or cash lump sum upfront. This does differ from carrier to carrier, although cash cancer plans are typically the same- paying the face amount all at once to the insured.

How do Cancer plans work? Cover Out-of-pocket Expenses

These cash plans are most popular since most medical bills are covered by the health insurance and as such defined benefits are less necessary. Cash cancer plans however paid to the policy holder can pay anything non-medical including replacing income due to loss of work. Non-medical are the main cause of selling assets such as cars, homes, and liquidating bank accounts to survive financially. Other terms such as Cancer life insurance have also popped up. This means if something else occurred causing an ultimate demise, the face amount would still go to a beneficiary. As a general rule the benefits are paid out without tax.

Why should I get one? How the money can be used.

Even if you have health insurance, cancer treatment can quickly charge up your out-of-pocket expenses. You may have seen the average patient with as much as 70% being non-medical expenses. Most are non-medical such as

- Job wage loss

- Covering high deductible major medical

- Transportation to a treatment center

- Mortgage and daily expenses

- Home health care, there is even income loss from a spouse who’s paycheck will diminish being by a partners side.

Cancer Insurance Tailored For You If you knew without a doubt you’d be diagnosed with cancer in a month, what would you do today, to make sure you're prepared?

Is Cancer Insurance worth it?

Consider these statistics:

Knowledge is Power-Only if you use the knowledge you have

- American Cancer Society Facts and Figures: Nearly 70% that are non-medical related bills.

- Three million cancer and critical illness cases each year and many are financially broke.

- Over 60% of all bankruptcies are critical and medical related. As many as 78% had health insurance and could not afford the unforeseen costs of what major medical did not cover.

- What are your chances? According to recent stats, as many as 1 in 3 people will have some form of cancer in their lifetime.

- Have you ever known anyone who had Cancer? Did it effect them financially? Looking back…How much would $20,000, $50,000 or $100,000 have helped them?

Statistics

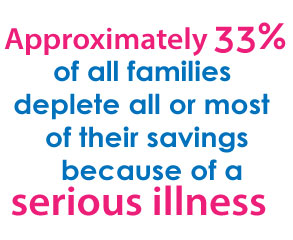

IF you knew without a doubt that you would be diagnosed with cancer in a month from now, what would you do today to protect yourself ? Is a Cancer policy right for me? 33% Of Families Deplete All or Most of Their Savings Due to Serious Illness.

Cancer Insurance costs start as low as $20 a month.